German environmental and human rights group Urgewald has exposed how major financial institutions continue to bankroll the metallurgical coal industry, funnelling nearly $52 billion into mine expansions between 2022 and 2024 despite global climate commitments.

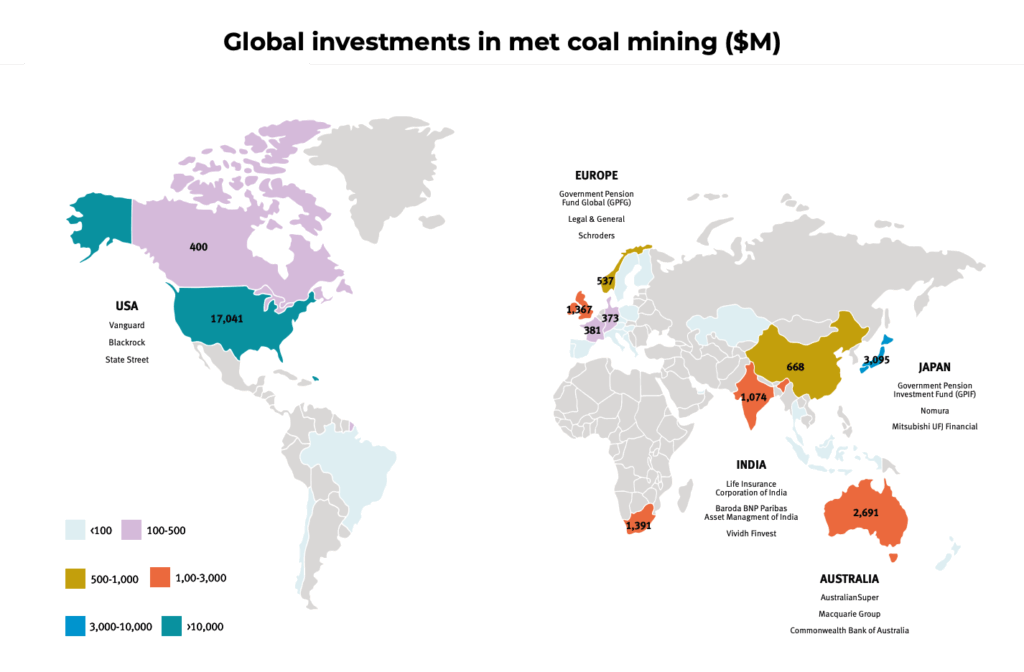

Its new report, Still Burning: How Banks and Investors Fuel Met Coal Expansion, reveals that banks provided $22 billion in loans and underwriting during the period, while institutional investors hold $30.23 billion in securities tied to companies expanding coal mining operations. The top investors include Vanguard, BlackRock, and State Street.

Urgewald, which earlier this year launched the first global database of metallurgical coal developers, says many financiers have pledged to end coal funding but exclude metallurgical coal from those promises, which the say it’s a “dangerous” loophole to climate goals. Met coal accounts for about 11% of global CO₂ emissions.

“Met coal fuels the climate crisis just the same as thermal coal,” Lia Wagner, met coal expert at Urgewald, says. “Banks and investors that ignore this fact are financing the destruction of our planet’s carbon budget.”

Steelmakers rely on metallurgical or coking coal to provide the carbon and heat needed to turn iron ore into molten iron in blast furnaces. While electric-arc furnaces are advancing, they must rely on scrap metal which means they can’t replace coking coal at industrial scale. Green-hydrogen methods can work, but they need abundant cheap renewable power and large-scale hydrogen production, which are not yet widely available.

Until those alternatives mature, analysts warn that met coal will stay critical to building the wind turbines, transmission lines and electric vehicles (EVs) driving the energy transition itself.

China, US lead financing

The report identifies 201 banks that financed metallurgical coal developers in recent years, with Chinese institutions dominating at 67% of global funding — roughly $14.7 billion. China Everbright, CITIC, and CSC Financial top the list, driven by demand from China’s massive blast-furnace steel industry.

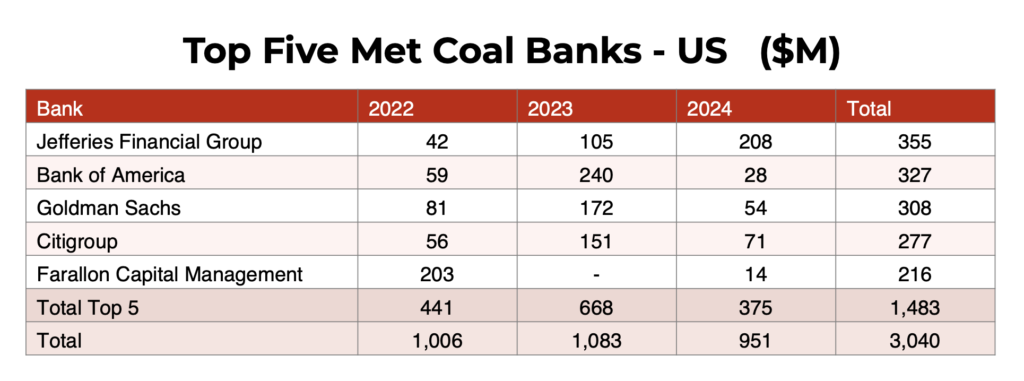

The United States ranks second, contributing $3.04 billion. Jefferies Financial Group leads U.S. financiers, increasing its met coal funding nearly 400% since 2022. In 2024, Jefferies, along with KKR Group and Deutsche Bank, arranged a $2 billion loan to Peabody Energy, which later abandoned a major acquisition following mine fires in Queensland, Australia.

Source: Still Burning: How Banks and Investors Fuel Met Coal Expansion.

“Even as the market signals decline, US financiers are clinging to met coal,” Wagner said. “None of this is about protecting steelworkers — it’s about cornering short-term profits.”

Europe’s “double standard“

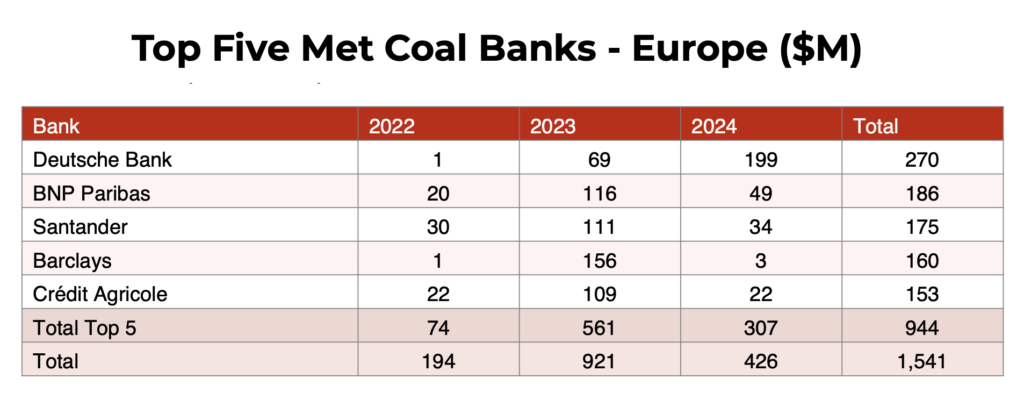

European banks, despite their climate rhetoric, channelled $1.54 billion into met coal developers over the past three years. Deutsche Bank, BNP Paribas, Santander, and Crédit Agricole are among the top financiers, many of which had pledged to stop backing new coal projects.

Much of this funding went to Glencore, whose mountaintop-removal mines in British Columbia have polluted waterways and destroyed ecosystems. Both Deutsche Bank and UBS previously vowed not to finance such operations but continue to support Glencore.

“It’s hypocritical for European banks to brag about thermal coal phase-outs while secretly funding met coal mining,” Cynthia Rocamora of Reclaim Finance, said.

“It’s hypocritical for European banks to brag about thermal coal phase-outs while secretly funding met coal mining,” says Cynthia Rocamora from Reclaim Finance.

Source: Still Burning: How Banks and Investors Fuel Met Coal Expansion.

Japan and Australia were also found to sustain coal’s lifeline. Over the reporting period, Japanese banks invested $1.22 billion in metallurgical coal developers, led by Mitsubishi UFJ, Mizuho, and SMBC Group. Japan’s steel giants, Mitsubishi Corporation and Nippon Steel, are expanding coal mines in Australia even as they promote “green transformation” campaigns.

Australia’s banks and investors added another $644 million, with Petra Capital and ANZ leading the way. Their financing has helped companies like Stanmore Resources and BHP extend coal mining well into the next century.

“ANZ’s coal policy is not acceptable in the midst of a climate crisis,” Adam Currie of 350 Aotearoa says. “Its policies contain carefully crafted loopholes that continue to permit the expansion of metallurgical coal.”

Coal’s future

While banks keep the loans flowing, investors are ensuring coal’s longevity. As of July 2025, institutional investors hold $30.23 billion in securities tied to companies expanding metallurgical coal operations, with U.S. investors dominating at $17.04 billion.

The world’s top five investors are Vanguard ($3.33 billion), BlackRock ($3.05 billion), State Street ($1.97 billion), Berkshire Hathaway ($797 million), and Japan’s Government Pension Investment Fund ($733 million). Collectively, they control nearly one-third of global met coal investments.

Source: Still Burning: How Banks and Investors Fuel Met Coal Expansion.

Despite its “sustainability-conscious” strategy, Japan’s GPIF has drawn criticism for holdings in Mitsubishi, Glencore, and Coal India. Meanwhile, Australia’s largest pension fund, AustralianSuper, has boosted its stake in Whitehaven Coal to 8.47%. Whitehaven’s Blackwater South and Winchester South projects threaten thousands of hectares of koala habitat.

Urgewald’s report concludes that continued met coal financing is incompatible with the 1.5°C climate target. With the EU’s Carbon Border Adjustment Mechanism taking effect and green hydrogen steelmaking gaining traction, the era of coal-based steelmaking, it warns, is nearing its end.

“The time for excuses is over,” Wagner says. “Financial institutions must close the metallurgical coal loophole once and for all because, simply put, coal is coal.”