Chilean copper heavyweight Codelco’s record-high offers to Chinese copper buyers are leading some to declare they will opt out of next year’s term contracts as questions grow about the relevance of the benchmark for Chinese buyers.

The Codelco premium, which is paid on top of London Metal Exchange copper prices, is often used as a reference for global copper supply contracts, as Codelco is the world’s largest copper producer and China the largest consumer.

Codelco did not immediately respond to emailed questions about the offers.

The willingness to eschew the closely watched term deals underscores growing questions about the benchmark’s relevance for China among delegates gathered in Shanghai for the World Copper Conference Asia.

The high premium partly reflects how easily Codelco cargoes can be delivered to the US Comex exchange, where forward prices for next year are hundreds of dollars above the LME, according to three traders. They said, however, that these trades are hard to do for Chinese buyers, suggesting the premium was aimed at big trading houses instead.

However, a fourth source said lower offers would only encourage Chinese buyers to sell their cargoes to the traders for export to the US.

All sources spoke on condition of anonymity given the commercial sensitivity of the matter.

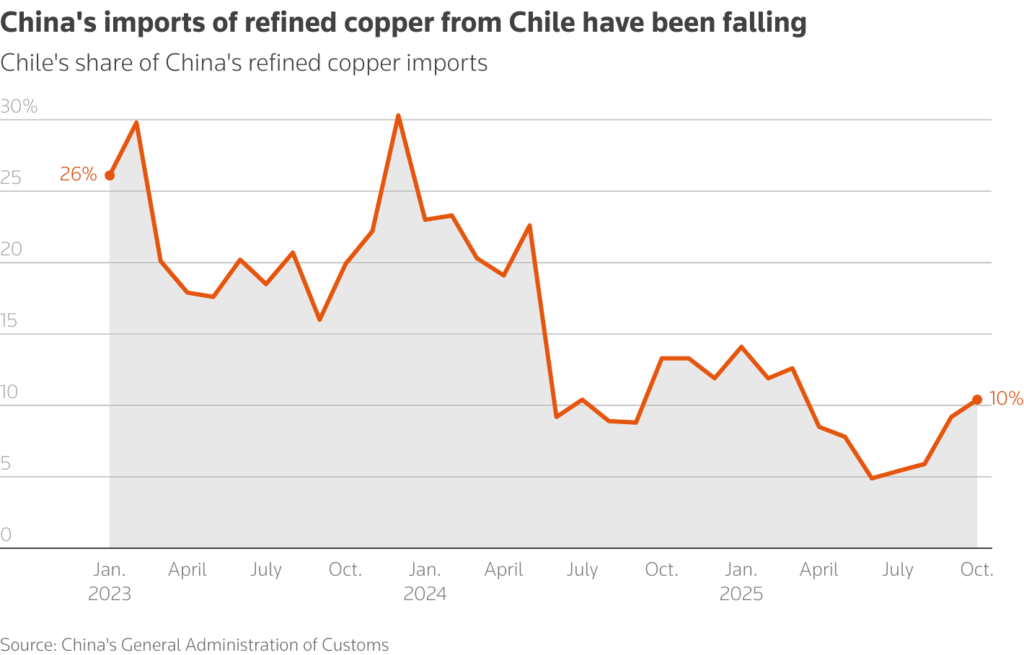

China’s imports of refined copper from Chile have fallen steadily since 2023 both in absolute terms and as a share of total imports, Chinese customs data shows.

The hike in the premium comes after fears of copper shortages next year pushed LME copper to an all-time peak of $11,200 a ton in late October. The metal traded at $10,868 a ton as of 0703 GMT.

Codelco, the world’s biggest copper miner, has already offered its European customers refined copper at a record-high premium of $325 a ton in 2026, a 39% jump year-on-year, Reuters reported last month.

(By Amy Lv, Lewis Jackson, Dylan Duan and Tom Daly; Editing by Jan Harvey and Conor Humphries)