With copper prices racing towards record highs, traders were in a bullish mood late last week as they descended on London for the largest gathering in the metals calendar.

Then came the Truth Social posts.

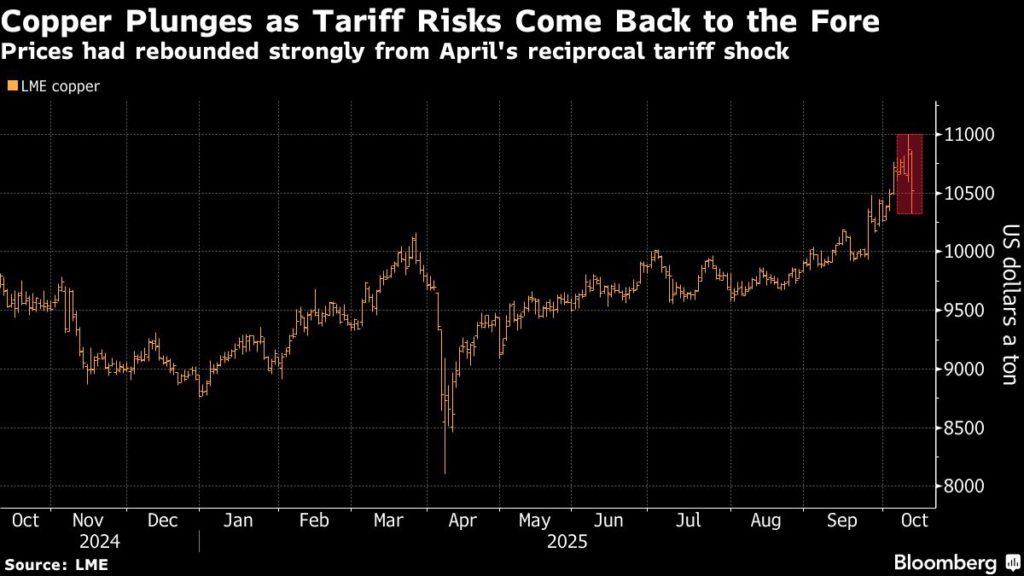

Prices tumbled as much as 5% on Friday after President Donald Trump threatened “massive” additional import tariffs on Chinese goods, putting an abrupt end to a rally that had lifted the critical industrial metal to within a whisker of record highs.

Now, as London fills with thousands of miners, traders, investors and manufacturers for a marathon of cocktail parties, conferences and commercial negotiations, one question loomed large: Where will copper prices go when the market reopens at 1 a.m. on Monday?

On the one hand, fresh China tariffs would be a hammer blow for demand, and a terse response from China on Sunday suggests little willingness to back down.

But if Chinese President Xi Jinping — or Trump — does step back from the brink, the focus could shift quickly back to a confluence of bullish factors that have had some traders betting that prices will soar to new all-time highs. Those drivers include accidents at some of the world’s biggest copper mines that have hit production, a wave of investor interest in metals as an alternative to the dollar, and long-term demand growth driven by electrification.

“This could be a game changer in the short term,” said Paul Crone, vice president for metals at SEFE Marketing & Trading Ltd. “I do think dips are still a buy — how deep the dip now is, is yet to be seen. Ultimately the Chinese will step in when we are low enough.”

Other markets that stayed open over the weekend suggested the selling pressure may continue, after Trump doubled down with a pledge to apply a blanket 100% tariff from Nov. 1 unless Xi rowed back the export controls.

Cryptocurrencies extended losses after a record selloff on Friday; Chinese bonds rallied in thin trading on Saturday, and onshore equities analysts are bracing for further losses, at least initially.

The renewed concerns about a US-China trade war highlight an uncomfortable truth for the copper market: demand for physical copper from real-world consumers has been lackluster in recent months, a fact that has given even die-hard bulls pause for thought.

Instead, prices have been lifted by a series of drastic supply disruptions.

In the Democratic Republic of Congo, the Kamoa-Kakula complex – co-owned by Ivanhoe Mines Ltd. and Zijin Mining Group Co. – started the year with a surge in output, cementing its status as one of the copper industry’s biggest success stories in recent years. But that project was hit by a major setback in May, after seismic activity triggered flooding in one of the underground mines.

Soon after, a July 31 rock blast at Codelco’s top mine in Chile claimed the lives of six people and halted activities for more than a week. While work at El Teniente has resumed in areas unaffected by the collapse, the Chilean industry’s worst accident in decades is imperiling the state-owned producer’s efforts to recover from a protracted slump that looks like costing it the title of world’s top supplier.

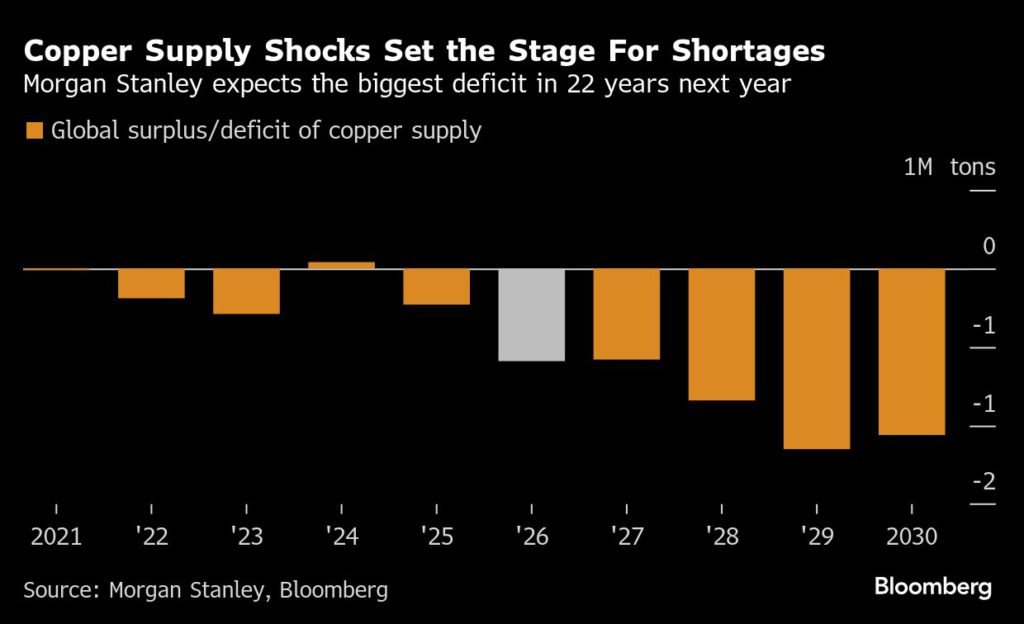

“Unfortunately, we’re exposing many vulnerabilities of the mining industry,” said Juan Carlos Guajardo, founder of mining consultancy Plusmining. “The industry doesn’t have the necessary strength to face this current period.”

And in the latest setback, a massive fatal mudslide knocked Freeport McMoRan Inc’s Grasberg mine in Indonesia offline last month, providing the catalyst in the rally that took copper prices to a peak of $11,000 last week. Tallied together with a string of supply losses from other misfiring projects, and the copper market looks set to be on the cusp of a severe shortage, with Morgan Stanley forecasting that production will fall short of demand by 590,000 tons next year, the biggest supply deficit since 2004.

The Grasberg incident “effectively nudged everyone that was already seeing a poorly balanced copper market to the reality of supply definitely underperforming,” Ivan Petev, the head of base metals at Gunvor Group, said at the Financial Times Metals and Mining Summit in London on Friday. Speaking before Trump’s tariff threats, he predicted that prices could rise above $15,000 a ton as soon as this year.

“Animal spirits have been awoken in the copper market,” he said.

Traders and analysts also point to a wave of investor interest in copper as metals more broadly benefit from the so-called “debasement trade.” While that has helped lift prices, it has also made some nervous.

“When I trade the price, I’m a little bit aware of the fact that we are melting up in everything. We’re melting up in gold, we are melting up in Nvidia, we are melting up in all the the US tech and well, okay, chickens may come to roost,” said Gunvor’s Petev.

For copper traders, Friday’s slump was the latest in what is becoming a familiar pattern of events, as prices are upended by the US president’s interventions.

Back in April, traders were pulling all nighters as Trump rolled out bombshell reciprocal tariffs, with prices collapsing by as much as 16% over three days as bets on his pro-business agenda unraveled, and panic about the darkening outlook for manufacturing and global trade set in.

Prices soon snapped back as Trump backtracked on the tariffs, but in July, he once again caused turmoil: first, by suggesting that he would impose a 50% import tariff on copper, then by ultimately imposing no tariff at all on the main traded form of the metal.

As gallows-humor memes started flying between metals traders in London over the weekend, one lamented that trading copper in 2025 felt more like trading crypto. (By Mark Burton)