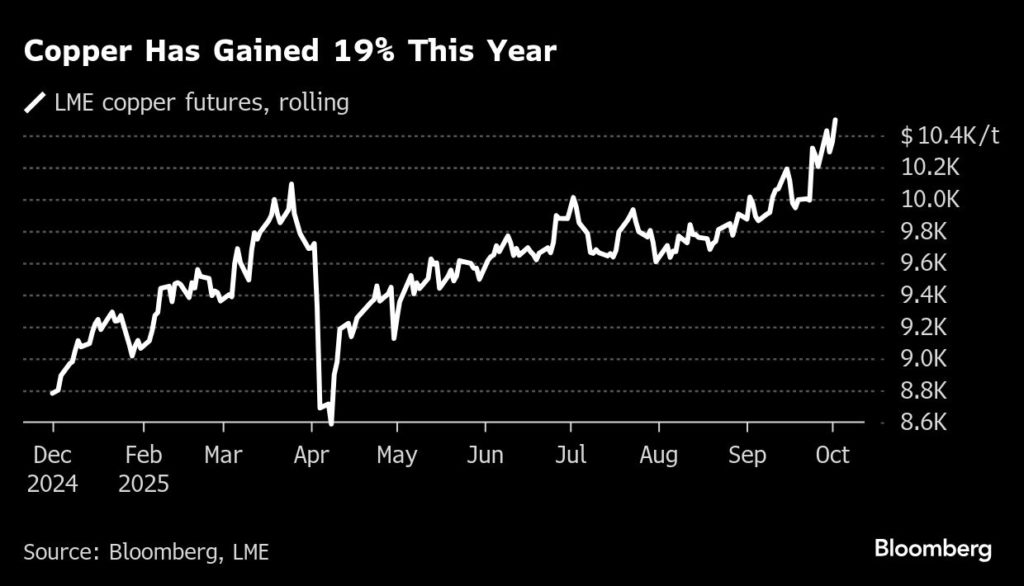

Copper prices climbed to their highest level in more than a year on Thursday, fueled by mounting global supply disruptions and growing expectations that US interest rate cuts will support demand for the industrial metal.

Benchmark futures on the London Metal Exchange (LME) briefly rose above $10,500 a tonne for the first time since May 2024, before trading at $10,497.50, up 1.1% as of 11:50 a.m. in London. Three-month futures traded above $10,976 per ton ($4.989 per lb.) on the CME, up 2.2% for the day.

The rally has been bolstered by news that Freeport-McMoRan (NYSE: FCX) declared force majeure at its giant Grasberg mine in Indonesia. The setback adds to a series of supply challenges across South America and Africa, tightening global availability.

“The scale of this disruption is very big,” said Albert Mackenzie, copper analyst at Benchmark Mineral Intelligence.

Benchmark estimates that supply losses will reach 591,000 tonnes

between September 2025 and the end of 2026, equivalent to about 2.6% of 2024’s global mine production, which analysts put at roughly 23 million tonnes.

The disruptions mean the copper market will swing into a deficit of around 400,000 tonnes in 2025, Benchmark said.

The impact has also led Goldman Sachs to revise its market balance forecast. The bank now projects a 55,500-tonne deficit for 2025, compared with its earlier expectation of a 105,000-tonne surplus. A small surplus is still expected in 2026.

Adding momentum to copper’s rally, US economic data reinforced expectations of interest rate cuts. An ADP private payrolls report showed an unexpected decline in September jobs, at a time when official data releases may be delayed by the ongoing US government shutdown.

Lower interest rates typically support commodities by boosting consumption and weakening the US dollar, which in turn makes dollar-priced metals cheaper for buyers using other currencies. A Bloomberg dollar index slipped for a fifth consecutive day on Thursday. (With files from Reuters and Bloomberg)