Copper edged higher as traders continued to digest US President Donald Trump’s decision to spare the most traded form of the metal from his 50% tariff, while a deadly mine accident in Chile raised supply concerns.

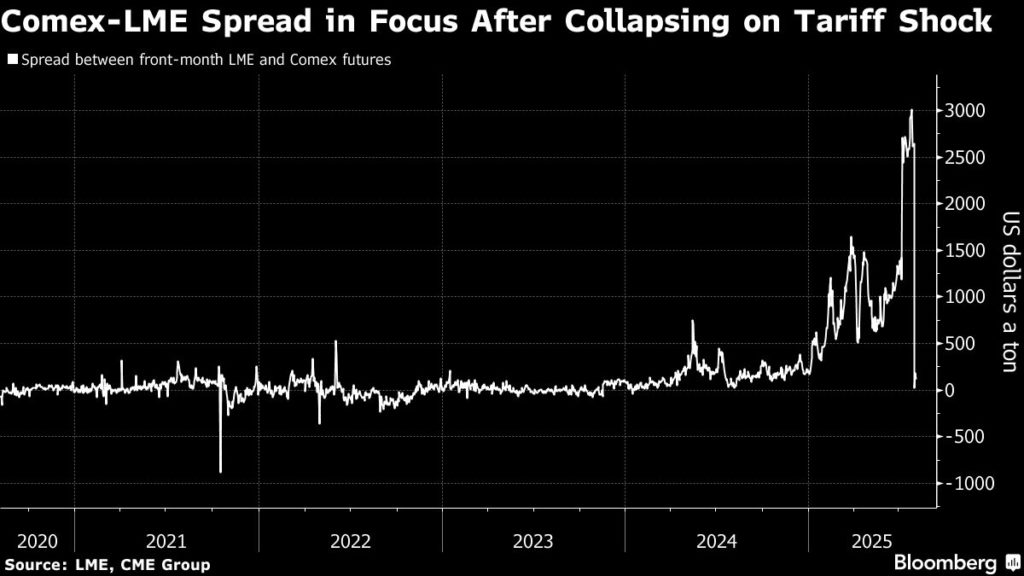

Copper rose as much as 1.1% on the London Metal Exchange, with trading conditions starting to settle after the White House’s shock move last week to exclude refined metal from the newly imposed import levy. The decision sent US prices plunging by a record 22% on Thursday, pushing them back to parity with the LME’s global benchmark.

A key question now is what will happen to the huge volume of copper that’s been shipped to the US in anticipation of tariffs, with the spreads between prices in London, New York and Shanghai likely to determine whether the metal flows back out quickly or remains in US ports. On Monday, US copper futures on CME Group’s Comex were trading about 1.5% — or $130 a ton — above those on the LME, undercutting the immediate rationale for exports.

“In the past, metal flowed between the CME and LME whenever the spread between those two prices moved outside a $100-200/t band,” Bank of America analysts led by Irina Shaorshadze said in an emailed note. “As the trade flows normalize, the LME-CME spread should revert to the historical mean-reverting relationship.”

Copper traders are also on alert for supply disruptions, after six people were killed in a tunnel collapse triggered by an earth tremor last week at El Teniente, which accounts for over a quarter of Chilean mining giant Codelco’s output. Underground operations are halted and — with the company launching an investigation into the causes — it’s unclear how long the stoppage will last or whether it will trigger changes to Codelco’s output goals.

El Teniente, one of the world’s biggest underground mines, produced 356,000 tons of copper last year. That volume is equivalent to more than a month of Chinese imports of refined copper.

The stoppage at El Teniente comes as the world’s copper smelters face intense competition to secure mine supply. Treatment fees — typically the main earner for smelters — remain at deeply negative levels on a spot basis, and plants in the Philippines and Japan have cut output or closed. Even in China, where output has remained robust, there is some speculation that production is reaching a limit.

Investors are also monitoring other unexpected mine disruptions, including at the massive Kamoa-Kakula complex run by Ivanhoe Mines Ltd. in the Democratic Republic of Congo. Still, Ivanhoe executives on Friday delivered an upbeat assessment on prospects for returning that mine to previous output guidance.

LME copper prices were 0.8% higher at $9,707.50 a ton as of 12:18 p.m. local time.

Other metals opened Monday flat to higher, gaining support from a weaker dollar. Iron ore futures in Singapore rose 1.5% to $101.50 a ton, recovering from their biggest weekly decline since April. Aluminum and zinc also rose.