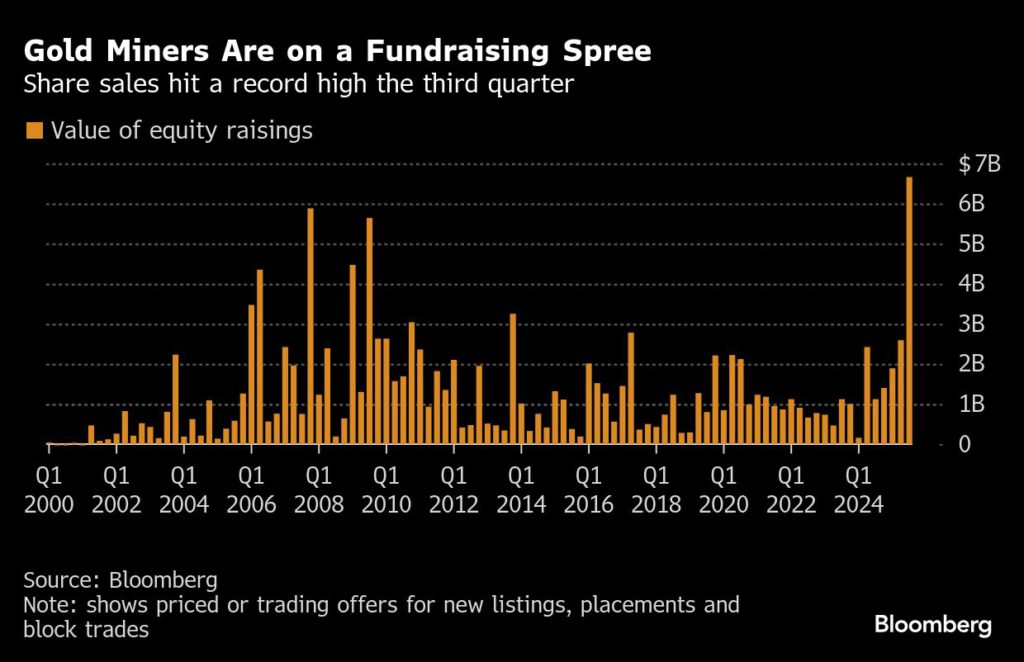

Gold miners have just raised their highest ever quarterly proceeds from share sales, with a prolonged rally in bullion prices attracting a range of investors seeking extra profit by betting on the companies that produce the metal.

Zijin Gold International Co.’s $3.2 billion initial public offering in Hong Kong — one of the largest this year — accounted for almost half of the $6.7 billion raised by the sector through new listings, placements and block trades in the three months to the end of September, according to data compiled by Bloomberg.

The bounty reverses a years-long trend that saw gold miners’ stocks lagging the metal itself. Investors shunned the sector after companies burned through billions of dollars on failed acquisitions, cost inflation and operational hiccups. Now, with healthier balance sheets and prices climbing at a speed not seen in decades, equities are once again viewed as a play that offers greater potential upside than holding bullion.

“You’re seeing generalists and people who’ve never owned gold being attracted by the price movement,” said Rob McEwen, a mining industry veteran who now leads McEwen Mining Inc. “I’m getting calls from people that have known me for a long time and say, can you tell me about gold?”

Asian gold miners took the lead in share sales in the third quarter, helped by Zijin Gold’s IPO, the world’s largest since May. The company’s shares closed 68% higher on their Hong Kong debut Tuesday.

But even without including the bumper Hong Kong sale, the latest proceeds are still the highest quarterly total in over a decade. Indonesia’s PT Merdeka Gold Resources began trading in Jakarta this month after raising more than $280 million in Indonesia’s largest IPO this year, and Shandong Gold Mining Co. sold about $500 million of stock.

Gold itself has surged more than 45% this year, hitting successive records — most recently a peak above $3,870 an ounce on Tuesday — due to factors including an easing of Federal Reserve policy, central bank buying and geopolitical tensions that fuel haven demand. This rally, as well as growing bets on de-dollarization, is drawing investors to gold mining stocks, giving producers and explorers fresh access to capital for projects and expansion.

“What’s changed this year is the gold prices started going up so fast that now they are actually making money,” said Brian Laks, partner and co-chief investment officer at Old West Investment Management, referring to gold miners. “The fundamentals have really become some of the best in any sector in the market.”

For the share rally to maintain its strength, however, investors may need reassurance that gold mining companies will spend their newfound profits more wisely than in previous boom times. The abrupt departure Monday of Barrick Mining Corp. CEO Mark Bristow is a reminder of the operational and management risks that come with miners — and which can prompt a divergent performance of the bullion price and miners’ shares.

Though Bristow made his name as a mining boss who could build where others failed, Barrick has underperformed its rivals of late, with gold production slumping to its lowest in more than two decades.

Growth has become a concern across the sector.

“They’ve got a wasting asset. So when you take ounces out of the ground, you’ve got to replace those ounces,” said Romano Sala Tenna, portfolio manager at Katana Asset Management in Perth. “The holy grail in gold is finding companies that are actually growing production.”

The rally in gold is widening the investable universe, however. While top players such as Newmont, Barrick and Agnico Eagle Mines Ltd. still dominate, a host of smaller, higher-cost producers and junior explorers have become much more appealing, said Waratah Capital Advisors chief investment officer Brad Dunkley.

The S&P/TSX composite gold index has more than doubled this year, with SSR Mining Inc., Lundin Gold Inc., New Gold Inc. and Aris Mining Corp. the four best-performing stocks, according to data compiled by Bloomberg. Even the worst performer on the index in that time, Wesdome Gold Mines Ltd., advanced 66%.

And there is plenty of room for growth. Though an MSCI index tracking global gold miners has more than doubled this year, it still trades at 13.4 times projected earnings over the next 12 months — below its five-year average of 13.7 times, according to data compiled by Bloomberg.

For Kevin Smith, chief investment officer at Crescat Capital, the bull market is just beginning, with early-stage developers and producers emerging after a 14-year bear market. His hedge fund is among investors snapping up exploration companies such as Snowline Gold Corp., Goliath Resources Ltd. and Sitka Gold Corp.

The “great rotation” into value stocks and commodities “is finally starting to happen,” said Smith. (By Yvonne Yue Li and Sybilla Gross)