- In recent days, Citi indicated there may be upside risk to Orica’s FY25 earnings, highlighting a solid performance in its blasting solutions segment despite ongoing thermal coal challenges.

- The analyst expects Orica to provide an upbeat outlook commentary for FY26, pointing to potential growth across every company segment and reiteration of its 13%-15% return on net assets target.

- We’ll explore how Citi’s view that solid blasting solutions performance could support Orica’s earnings may shape its investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Orica Investment Narrative Recap

Owning Orica often comes down to a belief in the company’s capacity to grow through advanced blasting solutions, digital innovation, and recent acquisitions, while managing cyclical exposure to resources, input costs, and integration risk. Citi’s recent view that solid blasting solutions could drive upside earnings is supportive of the key short-term catalyst: consistent segment execution, though thermal coal headwinds and integration risk remain the most significant uncertainties with limited impact from this update.

Orica’s May buyback announcement stands out as especially relevant, reflecting management’s confidence amid ongoing margin pressures. The buyback completion follows guidance upgrades for FY25 EBIT, suggesting that capital returns are being balanced with growth and risk-management priorities.

However, against this constructive backdrop, investors should still pay close attention to the underappreciated risk that…

Orica’s narrative projects A$8.6 billion revenue and A$691.8 million earnings by 2028. This requires 2.7% yearly revenue growth and an increase of A$593.7 million in earnings from A$98.1 million today.

Uncover how Orica’s forecasts yield a A$23.38 fair value, in line with its current price.

Exploring Other Perspectives

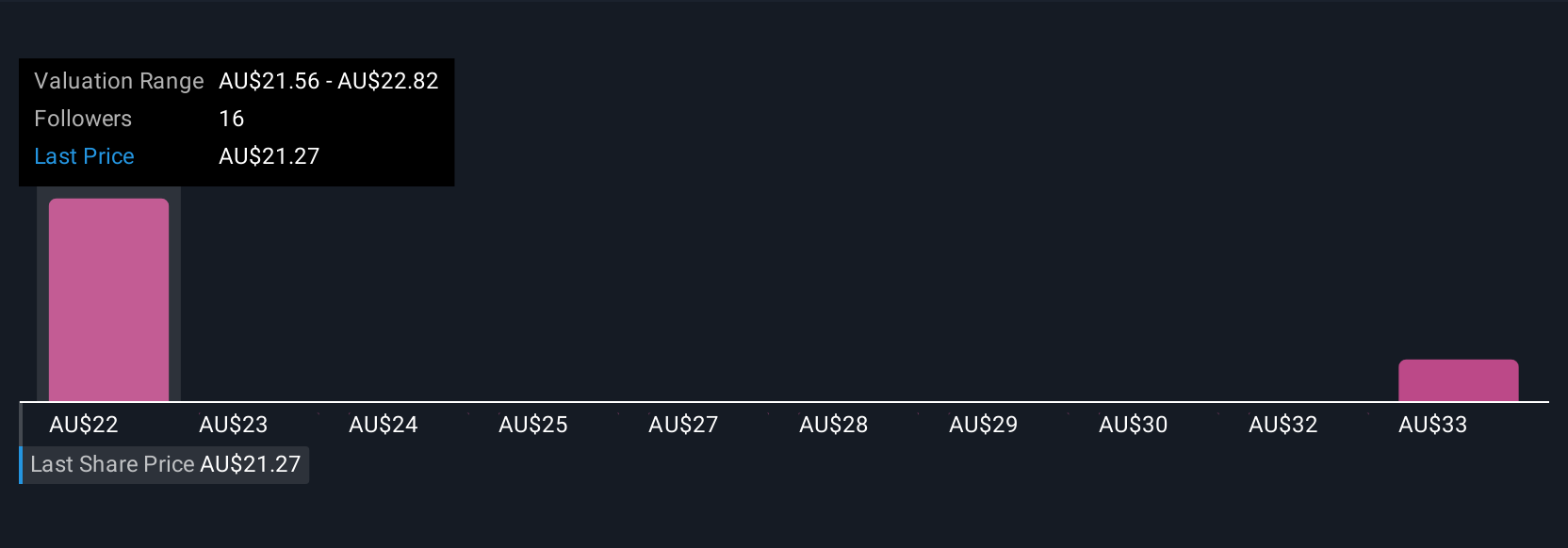

ASX:ORI Community Fair Values as at Nov 2025

Two members of the Simply Wall St Community set fair value estimates for Orica between A$23.38 and A$27.65 per share. While segment strength is in focus, supply constraints from safety upgrades could have a broader effect so explore more viewpoints to see the full picture.

Explore 2 other fair value estimates on Orica – why the stock might be worth as much as 21% more than the current price!

Build Your Own Orica Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Orica research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Orica research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Orica’s overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.