After peaking above US$20,000 per metric ton (MT) in May 2024, nickel prices have trended steadily down.

Behind the numbers is persistent oversupply driven by high output from Indonesia, the world’s largest nickel producer.

At the same time, demand from China’s manufacturing and construction sectors, traditionally large consumers of stainless steel, has been weak as the country’s beleaguered real estate sector continues to find its footing.

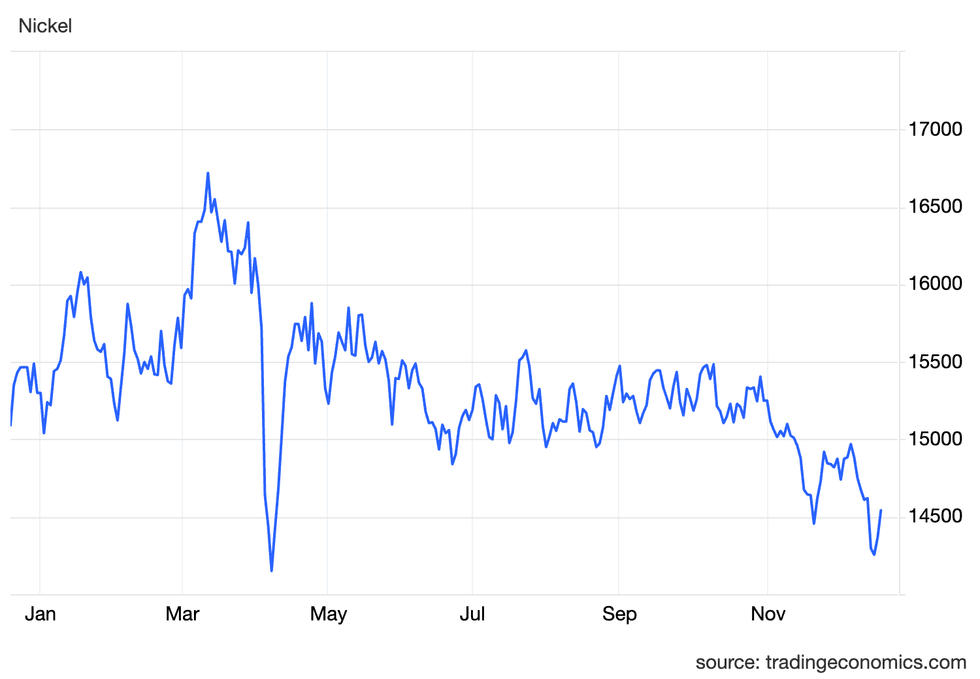

Nickel price in Q4

At the start of the fourth quarter, the nickel price was little changed from Q3, essentially trading in the US$15,000 to US$15,500 range. That’s the same level it had been at since April’s post-“Liberation Day” base metals market rout, which sent nickel spiraling to a year-to-date low of US$14,150.

Chart via TradingEconomics.

Nickel price, December 19, 2024, to December 18, 2025.

Cracks began to form at the end of October as it became clearer that the oversupply situation was likely to persist, pushing nickel back below the US$15,000 mark by mid-November. The price rebounded in late November, but failed to break US$15,000 again and slid toward a yearly low, reaching US$14,235 on December 15.

Oversupply continues to weigh on nickel

At the end of Q3, the expectation was that nickel prices would gain momentum as the monsoon season arrived in the Philippines; however, despite seasonal declines in output, the market ‘s supply glut persisted.

As of September 30, London Metal Exchange (LME) warehouses held 231,504 MT of nickel, and by November 28, stockpiles had grown to 254,364 MT, nearly 100,000 MT higher than the start of 2025.

According to a mid-December Shanghai Metals Market article, refined production decreased by 25,800 MT in November. Still, it was outpaced by inventory accumulation as downstream demand remained soft.

On the demand side, stockpile buildups coincided with the traditional off season for stainless steel producers, which account for 60 percent of total nickel demand, and weak end-use consumption led some producers to initiate output cuts. Additionally, Shanghai Metals Market notes that stainless steel demand was further impacted by the superior economics of recycled materials. The outlet also states that although production costs in Indonesia are lower than they are elsewhere, the price of nickel is rapidly approaching producers’ breakeven point.

In February, the Indonesian government changed its quota system, increasing nickel ore output to 298.5 million wet metric tons, up from 271 million wet metric tons in 2024. The move from the top nickel producer was designed to alleviate supply pressures, with increased production limited to major production areas.

This was followed in October by a change to the length of time production quotas are valid, shortening it to one year from three years and forcing miners to reapply for previously approved quotas for 2026 and 2027.

Changes were made to the application system after companies failed to meet environmental obligations; firms will now have to submit proof that they have the financial means to remediate land after operations are complete.

However, quota cuts may not necessarily be on the horizon — Bloomberg reported at the end of 2024 that the finance and investment ministries would oppose such a move due to the loss of tax revenue. Ewa Manthey, commodities strategist at ING, told the Investing News Network that she isn’t expecting cuts in 2026, and noted that prices would need to be sustained above US$20,000 for some time to “materially improve producer attractiveness.”

Adding to the metal’s woes is lower demand from the electric vehicle (EV) sector as more battery producers pivot away from nickel in their chemistries, looking to cheaper and more efficient lithium-iron-phosphate batteries.

Manthey explained that all factors have aligned for a bear market in nickel. “LME stockpiles are at a four year high, with Chinese and Indonesian cathode dominating,” she said, adding that growth in battery metals has been slower than expected, and that demand for stainless steel is sluggish on the back of global weakness in manufacturing.

How did nickel perform for the rest of the year?

The rest of the year wasn’t much different for nickel.

The oversupply situation carried over from 2024, with Indonesian producers making up roughly 60 percent of the market. Curtailments continued among western producers as they responded to low prices.

In April, the Indonesian government made a significant change to its royalty rates, hiking them to between 14 and 19 percent, depending on the nickel price. That’s up from the country’s previously imposed 10 percent flat rate, with a 2 percent royalty on nickel mattes destined for battery production.

As the second quarter began, base metals prices sank amid rising expectations of a global recession following US President Donald Trump’s “Liberation Day” tariff announcement on April 2.

Markets rebounded after initial tariff plans were walked back following a bond market squeeze that pushed 10 year treasury yields up by more than half a percentage point.

Nickel faced further pressures in July as the One Big Beautiful Bill was signed into law in the US, ending the federal EV tax credit, as well as other tax credits for expanding charging infrastructure.

The change came into effect on September 30 and eliminated a US$7,500 rebate on the purchase of new EVs. Before the end of the tax credit, data showed that American EV sales reached a record 1.2 million in the first nine months of 2025, with the share for EVs climbing to 12 percent in Q3 as consumers made purchases ahead of the program’s end.

Q4 data shows EV sales have declined significantly since the tax credit expired, and interest in EVs has fallen by 20 percent. The drop caused Ford Motor (NASDAQ:F) to pull back on its EV plans and take a US$19.5 billion writedown.

Investor takeaway

Nickel prices continued on a downtrend in 2025, and expectations aren’t much different for the year ahead.

Until the metal see ssustained upward momentum, it’s unlikely that curtailed western operations will be restarted.

For experienced investors, this may offer an opportunity to enter a market closer to the bottom than the top. However, until there is a significant correction in supply and demand fundamentals, the nickel market won’t have much of a tailwind, leading to a riskier market that may have a lengthy period before returns are realized.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.