Gold has run a remarkable rally throughout 2025, ascending to unprecedented heights. On Tuesday, the spot price set a new all-time record of $3,528.78 per ounce, surpassing its previous high of $3,500.05 from April, as geopolitical tensions roil global markets and investors pile into safe havens.

According to the World Gold Council, Q2 global gold demand rose by 3% year‑on‑year to 1,249 tonnes. On the supply side, the gold market has seen modest but steady growth. Mine production in Q2 reached a record 909 tonnes, contributing to a 3% year‑on‑year increase in total supply.

For the full year, forecasted production is expected to climb 1%, reaching about 3,694 tonnes, buoyed by new mining projects in Mexico, Canada and Ghana.

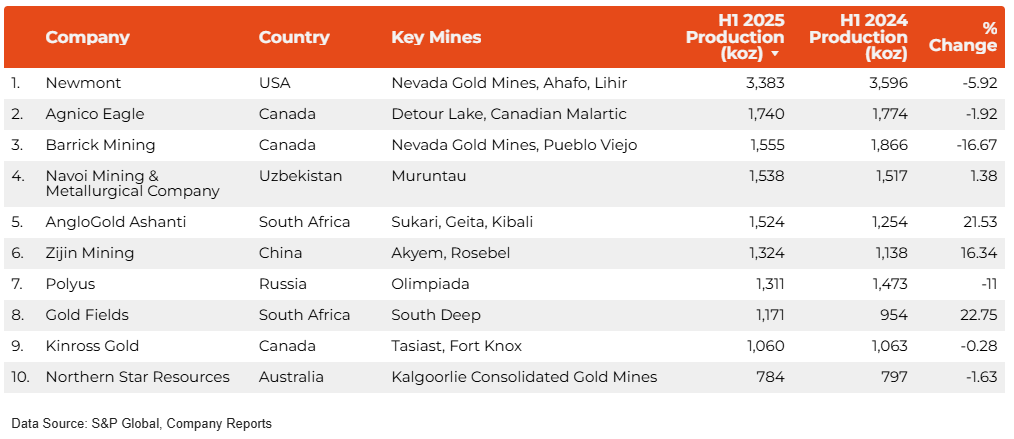

We rank the top 10 gold producers of the first six months of the year in kilo ounces (koz), tracking the percentage change from H1 2024.

#1 Newmont

Colorado-based Newmont (NYSE: NEM, TSX: NGT) maintains its top spot, producing 3,383 koz in H125, a 5% decline from the first half of 2024. Despite having sold several of its non-core assets, which contributed to its output decline for the six-month period compared to 2024, the company was successful in delivering improvements across its business, namely a 4% drop in all-in sustaining costs.

#2 Agnico Eagle Mines

Agnico Eagle Mines (NYSE, TSX: AEM) this year jumped into second place following strong performances across its Canadian mines, producing 1,740 koz. However, compared to the traditional “Big 2” of Newmont and Barrick, Agnico’s delivered the most consistent first-half production year over year. Based on its three-year projection, that trend is likely to continue.

#3 Barrick Mining

Canada’s Barrick (NYSE: B, TSX: ABX), this year changed its name, reflecting a strategic shift towards copper, saw its gold output plummet due largely to the seizure of its vast Loulo-Gounkoto mine in Mali as well as maintenance work at its Nevada operations. Moving from second place to third, Barrick produced 1,555 koz, a stark 16.7% decline from H124’s 1,866 koz.

#4 Navoi Mining

In fourth place is Navoi Mining, a Uzbekistan state-owned enterprise, which produced 1,538 koz, a 1.6% improvement from 2024. Navoi’s operations are backed by the massive Muruntau deposit in the Kyzylkum Desert and an estimated 150 million oz. of gold resources across the region. Last year, it invested $23 million in Muruntau’s expansion.

#5 Anglogold Ashanti

South Africa’s Anglogold Ashanti (JSE: ANG, NYSE: AU, ASX: AGG) is in fifth place, churning out 1,524 koz, up an impressive 21.5% over last year. The production uptick is a result of its Sept. 2024 acquisition of smaller rival Centamin in a $2.5 billion deal that gave it ownership of the Sukari mine in Egypt – the country’s largest and first modern gold operation.

#6 Zijin Mining

China’s biggest gold and copper producer Zijin Mining came in sixth place with 1,324 koz, up a significant 16.3% over the first six months of 2024. That momentum is likely keep up, as in June, Zijin agreed to buy one of the largest gold mines in Kazakhstan, the Raygorodok mine, for $1.2 billion.

#7 Polyus

Polyus dropped to the seventh spot following an 11% decline to 1,311 koz from the year prior. Even so, Russia’s largest gold producer posted a 20% year-on-year jump in first-half profit to $1.4 billion, a reflection of the high gold price on a global scale.

#8 Gold Fields

Gold Fields (JSE: GFI) produced 1,171 koz, a 22.7% jump from the 954 koz produced in H1 2024. This month, the South African miner announced it is closing in on its A$3.7 billion ($2.4 billion) takeover of Australia’s Gold Road Resources (ASX: GOR), with shareholders set to vote on the deal on September 22.

#9 Kinross Gold

Kinross Gold (TSX: K) ranks ninth, churning out 1,060 koz in gold equivalent, just shy of the 1,063 koz produced in the same period a year ago. Production numbers could start to tick up again soon, as the Canadian miner in April announced its buying a 9.9% equity stake in Nevada-focused Eminent Gold.

#10 Northern Star Resources

Australian gold miner Northern Star Resources rounds out our list with 784 koz produced, down 1.6% from 797 koz produced in last year’s H1. In Dec. 24, Northern Star said it will buy De Grey Mining in an all-share deal valued at A$5 billion ($3.3 billion) as high gold prices continue to spur consolidation in the sector.

Notable miners falling outside the top ten include Freeport McMoRan (NYSE: FCX) producing 604 koz; Evolution Mining (ASX: EVN) with 369 koz; IAMGOLD (NYSE: IAG, TSX: IMG) at 334 koz; and Alamos Gold (TSX, NYSE: AGI), which produced 262 koz.