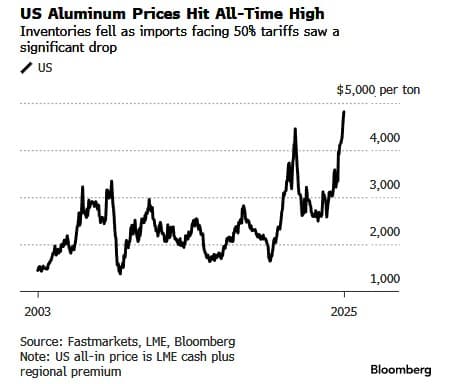

- The U.S. all-in aluminum price hit a record $4,816 per ton, nearly double its 2023 lows, as inventories tightened sharply.

- Trump’s 50% steel and aluminum tariffs slashed Canadian imports and spurred renewed interest in domestic production.

- Analysts warn that rising aluminum costs could intensify inflationary pressures amid strong global demand from AI and data center construction.

Aluminum prices in the U.S. climbed to new record highs on Monday as domestic inventories tightened sharply, driven by the Trump administration’s steel and aluminum tariffs designed to bolster and revitalize America’s industrial base.

According to Bloomberg, the all-in U.S. aluminum price, combining the London Metal Exchange (LME) benchmark and the U.S. Midwest delivery premium, hit a record high of $4,816 per ton, nearly double the level from the December 2023 lows.

The U.S. remains heavily dependent on foreign aluminum imports, lacking any robust domestic production capacity to satisfy domestic demand. Canada, its largest supplier, has seen shipments fall sharply since President Trump imposed aluminum tariffs in March and later doubled them to 50% in June.

From April to July, U.S. aluminum imports averaged 64,000 tons per month below the 2024 baseline, partially offset by an 18,000-ton increase in scrap imports, according to Morgan Stanley analysts led by Amy Gower.

Gower noted that the U.S. aluminum inventory has been shrinking by about 46,000 tons per month due to tariff uncertainty, particularly around the U.S.-Canada trade spat.

“However, the destocking likely cannot continue indefinitely, and the recent rise in the Midwest premium suggests that some buying is returning,” she said.

“The steel and aluminum tariffs shut down avenues for circumvention — supporting the continued revitalization of the American steel and aluminum industries,” Jeffrey Kessler, the Commerce Department’s under secretary for industry and security, wrote in a statement shortly after the Trump administration unveiled 50% steel and aluminum tariffs to include 407 additional product types over the summer.

Meanwhile, aluminum moved higher by .3% to $2,878 a ton on the London Metal Exchange, extending gains after reaching a three-year high last week.

On the Shanghai Futures Exchange, open interest in aluminum contracts hit a new record of 745,000 lots. Futures are at their highest since last November, driven by supply constraints and elevated demand.

BofA Securities analyst Matty Zhao noted that Chinese aluminum shares are undervalued, as construction of data centers and artificial-intelligence power equipment has fueled demand for the industrial metal.

“We have seen some long-term funds diverted from Chinese stocks to aluminum futures,” Shuohe Asset Management Co. Domestic analyst Gao Yin said, adding that futures will likely move higher.

Rounding back to the U.S., one can only imagine that rising industrial metal prices will add more inflationary cost-push pressures.